WNBA Fandom in Three Figures

The WNBA is currently one of the most intriguing sports organizations. It stands on the verge of a cultural breakthrough, but its economics remain uncertain. Combining this dichotomy with the various forces reshaping fandom, you have a league that fascinates from both cultural and economic perspectives.

The WNBA is particularly intriguing because, although it lacks a substantial history of fandom, it benefits from the NBA’s marketing power and a growing societal interest in women’s sports, particularly in terms of media coverage. Additionally, the WNBA enjoys the advantage of a less saturated market for women’s sports. However, the market potential remains uncertain, and women’s sports are becoming a more competitive arena with relatively new leagues in volleyball, softball, rugby, and hockey.

Today, I have three figures from the 2025 Next Generation Fandom Survey. These figures don’t answer the question of the WNBA's future prospects; instead, they highlight key issues and challenges related to the W.

The Data

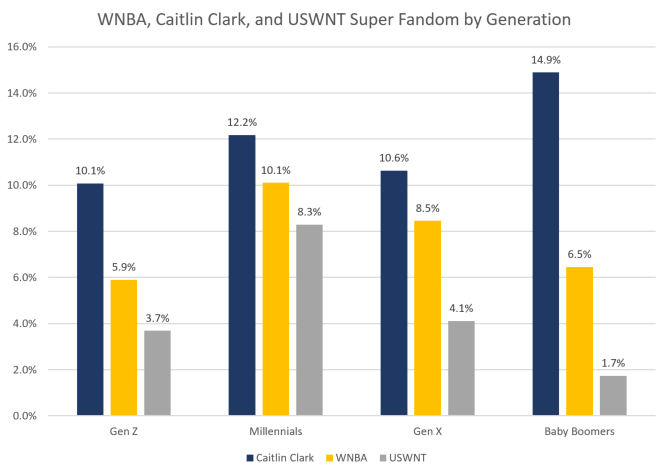

Figure 1 shows “Super Fandom” for Caitlin Clark, the WNBA, and the USWNT. The super fandom rate is the percentage of respondents rating their fandom a 7 on a 7-point fandom scale.

Clark’s super fandom is substantially higher than the WNBA's. This suggests that Clark has become a pop culture figure in addition to being an elite basketball player. For comparison, LeBron James's super fandom rate in the survey was 16.9%, while the NBA's was 17.5%.

The USWNT super fandom rate is only 4.4%, and the NWSL rate is even lower at 3.85% (the NWSL rate is not reported in the figure). While the lack of multi-year data limits conclusions, the data suggests that the WNBA is far more popular than women’s soccer. It is not clear if the USWNT has faded in popularity due to retiring stars or if the WNBA’s growing prominence has taken fandom from other women’s sports. The relevant insight is that women’s sports ventures may be competing as substitutes rather than acting as complements.

Figure 2 shows super fandom for the male and female segments.

Male fandom is higher than female fandom for Caitlin Clark, the WNBA, and the USWNT. While this finding is counterintuitive, it suggests something important about women’s sports fandom. At this moment, fandom is more about the “sports” rather than the “female” component.

Figure 3 shows super fandom for the four major sports consuming generations: Gen Z, Millennials, Gen X, and Baby Boomers.

The WNBA shows the typical “sports” pattern, I have observed in prior years of the survey: fandom peaks with Millennials and Gen X and lags with Gen Z and Baby Boomers. The WNBA’s lowest super fandom rate is in Gen Z.

The USWNT shows a similar pattern, but its fandom is primarily concentrated among Millennials.

Caitlin Clark’s fandom is interesting as it is higher among older consumers. This further illustrates that Clark is a media and cultural star in addition to being a basketball player.

Insights

The WNBA is fascinating because there is a mismatch between its media influence and fandom. I suspect that the WNBA receives more media coverage than the NWSL, PVF, PWHL, WER, and WPF combined. It’s a consequence of multiple factors, such as the league’s relationship with the NBA. However, despite its advantages, the league’s future is uncertain, and the league is still trying to achieve profitability.

The league has a significant cultural footprint and a legacy of mainstream stars, but the “fan” market for women’s basketball remains speculative. Is there a hidden segment of female fans who have been ignored? Will younger generations show greater support for women’s sports? The data suggest that the WNBA does better with men and struggles with Gen Z. We can speculate (and others can advocate), but the ultimate answers are unknown.

The counterintuitive fandom results for the gender segments start to reveal the complexity of fandom. A critical insight for marketers and cultural commentators is that “fandom” is a basic human trait, as fandom reflects people's need for shared culture. This insight leads to some complexities when examining fandom rates, as certain characteristics correlate with the propensity to be a fan. For example, I have consistently found that political conservatives are more likely to be fans. I conjecture that this occurs because conservatives are more engaged with traditional cultural institutions. In fact, the super fandom rate for the WNBA is 11.9% for conservatives and 7.5% for liberals. This is a stunning result for most observers.

While the league is fascinating on its own, the Caitlin Clark phenomenon makes it the most intriguing league at the moment. Having fewer fans than Caitlin Clark suggests that Clark is a star beyond basketball and that the league has made marketing missteps. Every metric suggests that Clark is the key to the league's future, but the women’s basketball establishment has been hesitant to fully embrace Clark.

The Next Generation Fandom Survey

The 2025 installment is the fifth edition of the Next Generation Fandom Survey. The Next Generation Fandom survey is an annual look at the state of sports, entertainment, and cultural fandom in the United States. The survey began during my tenure as the Emory Marketing Analytics Center Director. The study aims to measure the current state of fandom across a wide range of sports and other cultural categories and to collect data on the factors that underlie fandom. The 2025 Survey includes responses from over 1600 individuals split nearly evenly across the four primary generations: Gen Z, Millennials, Gen X, and Baby Boomers. The sample is also split evenly across genders and is racially representative. Data collection occurred from March 13, 2025, to April 2, 2025.