When I think of the NBA’s marketing strategy, I think of glamour, pop culture, and youth. I also wonder if this is the best positioning for a sports league.

The NBA is the most glamorous league with music and movie stars inhabiting the front rows in LA and New York, especially during the playoffs. Superstars, pop culture focus, and a youth orientation seem like a recipe for success in the modern sports environment. In particular, a pop culture focus is tailor-made to leverage social media channels and to attract an increasingly diverse group of younger fans.

Yet, the NBA's outlook is ambiguous. The 2024 season started with disastrous TV ratings, the All-Star Game weekend seems broken, and the NBA Finals are watched by less than 5% of the population. The Finals viewership is a critical data point because the Finals occur after the NBA playoffs have placed the league on center stage for a month. The 2025 Finals feature the small market (and small brand equity) Pacers and Thunder, so this year's viewership will provide a measure of the NBA’s core fandom.

Aside: Last year’s Finals featuring the number four market Dallas Mavericks and one of the league's elite brands in the Boston Celtics averaged 11.3 million viewers. With this year’s finals featuring Indiana and Oklahoma City, we may be looking at an average viewership of less than 10 million. My prediction is a number around 9 million.

Update: I wrote the preceding (very obvious) prediction before the start of the Finals. Game 1 averaged 8.9 million viewers – the lowest since the “COVID Bubble” series. With an average viewership of 8.9 million in game one, my prediction may have been optimistic.

Every sports league is fascinating in 2025. It is an age of technological and demographic change with inevitable consequences for America’s cultural landscape. Today’s post is a data-oriented examination of NBA fandom. I have four figures generated using data from the Next Generation Fandom Survey (a survey description is provided at the bottom of the article). The data shows fandom differences across age, gender, and racial segments. It’s a quick but informative look at NBA fandom.

The Big 3 Sports (Plus the WNBA)

The first figure shows Super Fandom and Apathetic rates for the “Big 3” American sports leagues (the NFL, MLB, and the NBA) and the WNBA. I’ve included the WNBA because it's another basketball league and it helps highlight some salient gender fandom issues.

The NFL has significantly more fans and fewer apathetics than the NBA or MLB.

There is no clear-cut number two in American sports. The WNBA has a higher super fandom rate but also a higher apathy rate compared to MLB.

The WNBA has fandom rates that are on par with sports like the NHL (8.4%) and MLS (7.1%). However, the WNBA has an extremely high apathy rate.

Generations

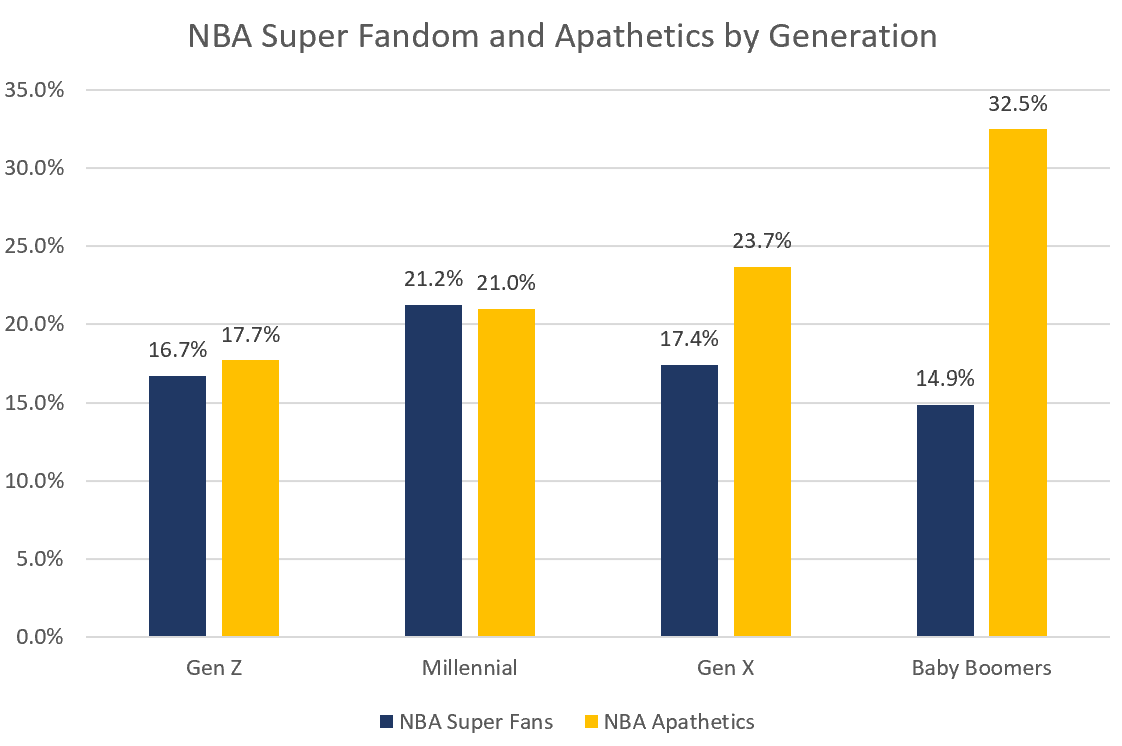

The second figure shows fandom by generation. Baby Boomers, Gen X, Millennials, and Gen Z all came of age during different technological eras and in different demographic environments. How do these different environments (and the NBA’s youth-oriented strategy) impact fandom?

Millennials have the highest rate of super fandom, followed by Gen X, Gen Z, and the Baby Boomers.

The rate of NBA apathy increases with the age of the generations. Almost one-third of Baby Boomers rate their fandom as a 1 on the 7-point scale.

Gen Z super fandom is substantially lower than that of Millennials (16.7% versus 21.2%). Despite the league’s embrace of pop culture and social media, Gen Z fandom trails Gen X’s. However, Gen Z has the lowest rate of apathy.

Gender Differences

The third figure presents results for gender segments. The figure includes rates of Super Fandom and Apathy for the NBA and the WNBA. The figure also includes the percentage of each group who responded affirmatively to whether they believe the NBA Cares about having them as fans.

The male Super Fandom rate is almost two and a half times the female rate (24.1% vs 10.9%), while the female Apathetic rate is almost twice the male rate (30.6% vs 16.9%).

The male WNBA fandom rate is about double the female rate, while the apathy rates for the WNBA are similar across the genders.

Men feel significantly more valued by the NBA. Men feel slightly more value by the WNBA.

The Racial Divide

The fourth figure shows the rates of Super Fandom, Apathy, and whether the NBA Cares, for two racial segments: Whites and Non-Whites.

For the White subsample (N=1067), the rate of Super Fandom was 12.4%, and the Apathetic rate was 27.6%.

For the Non-White sample (N=543), the rate of Super Fandom was 29.8%, and the Apathetic rate was 11.8%.

The Non-White segment also felt significantly more valued as fans than the White segment (68.3% vs 52.9%).

Commentary

The NBA is a fascinating league for considering fandom. It is the league most connected with pop culture and the league with a history of creating superstars that transcend sports. All sports leagues have many questions about what the future holds. How can leagues attract future fans (Gen Z and Gen Alpha)? How can leagues attract fans in an increasingly diverse America? Will female fans be the next growth segment?

The preceding data provides ambiguous signals about the NBA's future fandom prospects. The data may be interpreted as positive or worrisome. For instance, the NBA’s stronger performance with younger cohorts suggests a positive future. However, the NBA’s performance with the Boomers suggests that the league’s youth emphasis may alienate older fans.

The gender segment results highlight the continuing challenges of building women’s sports. Men represent the bulk of NBA fans, while a large percentage of women are uninterested in the NBA. Men even outnumber women WNBA fans by a margin of 2 to 1. The data suggests that men remain the core audience for sports, whether men or women are playing. The women’s apathy rate for the WNBA and the NBA is similar, at just over 30%. The long-term potential of the female sports fan segment remains unknown.

The data on race is stunning. The segmentation into “White” versus “Non-White” segments is relatively crude, but it reveals a striking pattern. In addition, a more granular analysis reveals the NBA Super Fandom rate for the Black segment was 33.4%, and the NBA Cares rate was 76.5%. The NBA’s performance with the Non-White segment suggests that the league is well-positioned for the future as America evolves to a more diverse population. However, the NBA’s weakness with the White and older segments suggests weakness with large segments of American sports consumers.

What's the bottom line? The NBA probably has more mixed signals than any other sports league. The league does well with young people, but the data also suggests that the NBA doesn’t do well over the extended fandom lifecycle. The league also seems well-positioned for a more diverse future America, but the data also suggests that the league does poorly with the largest racial segment. It's an intriguing situation highlighting something fundamental about fandom: fandom is cultural passion, and culture is complicated. Creating a cultural product that appeals to the young can limit its attractiveness to the old.

The Next Generation Fandom Survey

The 2025 installment is the fifth edition of the Next Generation Fandom Survey. The Next Generation Fandom survey is an annual look at the state of sports, entertainment, and cultural fandom in the United States. The survey began during my tenure as the Emory Marketing Analytics Center Director. The study aims to measure the current state of fandom across a wide range of sports and other cultural categories and to collect data on the factors that underlie fandom. The 2025 Survey includes responses from 1610 individuals split nearly evenly across the four primary generations: Gen Z, Millennials, Gen X, and Baby Boomers. The sample is also split evenly across genders and is racially representative. Data collection occurred from March 13, 2025, to April 2, 2025.